We simplify the UAE regulatory requirements so your company stays compliant

Comprehensive Service Portfolio

Banking Compliance Advisory

Capital Markets Compliance

Financial Services Compliance

Committed to Securing Your Financial Future

ABM Global Compliance (UK) Limited is a specialist consultancy firm providing cross-jurisdictional regulatory compliance, licensing, and advisory services to institutions within the banking, financial services, and capital markets sectors. As an affiliated entity of ABM Consulting Group PLC (UK)—a London-headquartered network of Chartered Accountants and Regulatory Experts—we deliver legally robust, jurisdiction-specific, and operationally effective compliance solutions.

Our clientele spans over 250 regulated and unregulated institutions globally, including banks, fintech firms, payment institutions, consumer credit entities, and capital market intermediaries. We are committed to delivering practical compliance frameworks that align with both the letter and spirit of prevailing regulations.

To enable financial institutions to achieve and maintain full regulatory compliance across multiple jurisdictions by delivering reliable, customised, and forward-looking advisory solutions.

To be recognised as the global leader in compliance advisory—bridging the gap between traditional financial regulation and emerging digital asset governance frameworks.

On Time Service

Team of Professionals

Analyze Your Business

Building Resilient Financial Strategies for the Future

0%

Skilled and Profesional Advisors

0k+

Active Users Product On Create

0+

Clients Happy in the Long Term

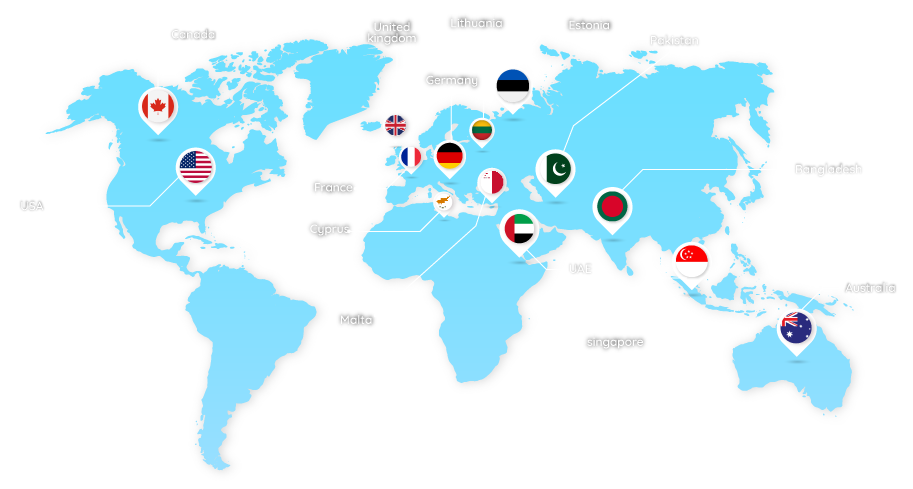

Regulatory Reach and Jurisdictional Coverage

Our regulatory advisory and licensing services extend across multiple key jurisdictions:

United Kingdom

United States

United Arab Emirates

Canada

Singapore

Australia

European Union

Our Approach

At ABM Global Compliance, we adopt a risk-based, regulator-aligned, and jurisdiction-specific approach to compliance. We work closely with clients to assess business models, identify regulatory exposures, and implement governance structures that ensure operational continuity and supervisory alignment.

Whether assisting with licence applications, enhancing compliance frameworks, or advising on regulatory transformation initiatives, our team of legal and regulatory professionals provides timely, actionable, and enforceable solutions.

Digitize Your Business Now Best Experts

Initial Consultation

Data Analysis

Strategy Development

Our service location

- United Kingdom

- United States

- Canada

- United Arab Emirates

- Australia

- Singapore

- Germany

- France

- Estonia

- Lithuania

- Malta

- Cyprus

- Pakistan

- Bangladesh

Innovative Solutions for a Dynamic Market

0+

Small Payment Institutions

0+

Authorised Payment Institutions

0+

Electronic Money Institutions

4.7

Client Success: Highlight how your firm helped clients

Achieving Financial Goals Together

Finance Insights, Updates and Trends

Our Partners