Introduction to Capital Markets

Capital markets are platforms where entities—corporations, governments, and investors—buy and sell financial instruments such as stocks, bonds, derivatives, and other securities. They play a vital role in economic growth by mobilizing savings for productive investment and enabling price discovery, liquidity, and risk management.

Importance of Compliance in Capital Markets

Capital markets are heavily regulated to ensure:

- Investor protection

- Market integrity

- Transparency

- Prevention of fraud and manipulation

Non-compliance risks include financial penalties, reputational damage, legal consequences, and even loss of operating licenses.

Regulatory Landscape

Capital market participants must comply with a complex matrix of local and international regulations, including but not limited to:

- Securities Laws & Acts: e.g., Securities Act, Securities Exchange Act.

- Market Conduct Regulations: Insider trading, market manipulation rules.

- Financial Reporting & Disclosure Standards: IFRS, GAAP.

- Anti-Money Laundering (AML) & Counter-Terrorist Financing (CTF) Rules.

- Data Privacy & Cybersecurity Regulations: GDPR, CCPA.

- Specific Market Regulations: MiFID II (EU), Dodd-Frank Act (US), SEBI Regulations (India), FCA Rules (UK).

Core Functions of Capital Market Compliance Advisory

A. Regulatory Compliance Assessment & Gap Analysis

- Mapping existing organizational policies, processes, and controls against applicable regulations.

- Identifying compliance gaps and risks.

B. Policy Development & Implementation

- Drafting, updating, and implementing compliance manuals, codes of conduct, and operational procedures.

- Ensuring alignment with evolving regulatory requirements.

C. Risk Management & Internal Controls

- Designing control frameworks to mitigate compliance, operational, and financial risks.

- Performing periodic internal audits, risk assessments, and control testing.

D. Transaction Monitoring and Trade Surveillance

- Implementing systems and processes to detect suspicious trading patterns and market abuse

- Monitoring insider trading, front-running, wash trading, spoofing, and other manipulative practices.

E. Reporting & Disclosure Compliance

- Advising on timely, accurate preparation and submission of regulatory filings (e.g., 10-K, 10-Q, periodic reports).

- Supporting disclosure of material information, financial statements, and insider transactions

F. Anti-Money Laundering (AML) & Know Your Customer (KYC) Compliance

- Designing and implementing AML frameworks in accordance with FATF recommendations and local regulations.

- Conducting customer due diligence (CDD), enhanced due diligence (EDD), and ongoing transaction monitoring

G. Technology & Regulatory Technology (RegTech) Advisory

- Assessing and deploying compliance technologies for automated monitoring, reporting, and data analytics.

- Advising on cybersecurity controls to safeguard sensitive financial and client data

H. Training & Awareness Programs

- Developing tailored compliance training for employees and management.

- Fostering a culture of compliance and ethical conduct throughout the organization

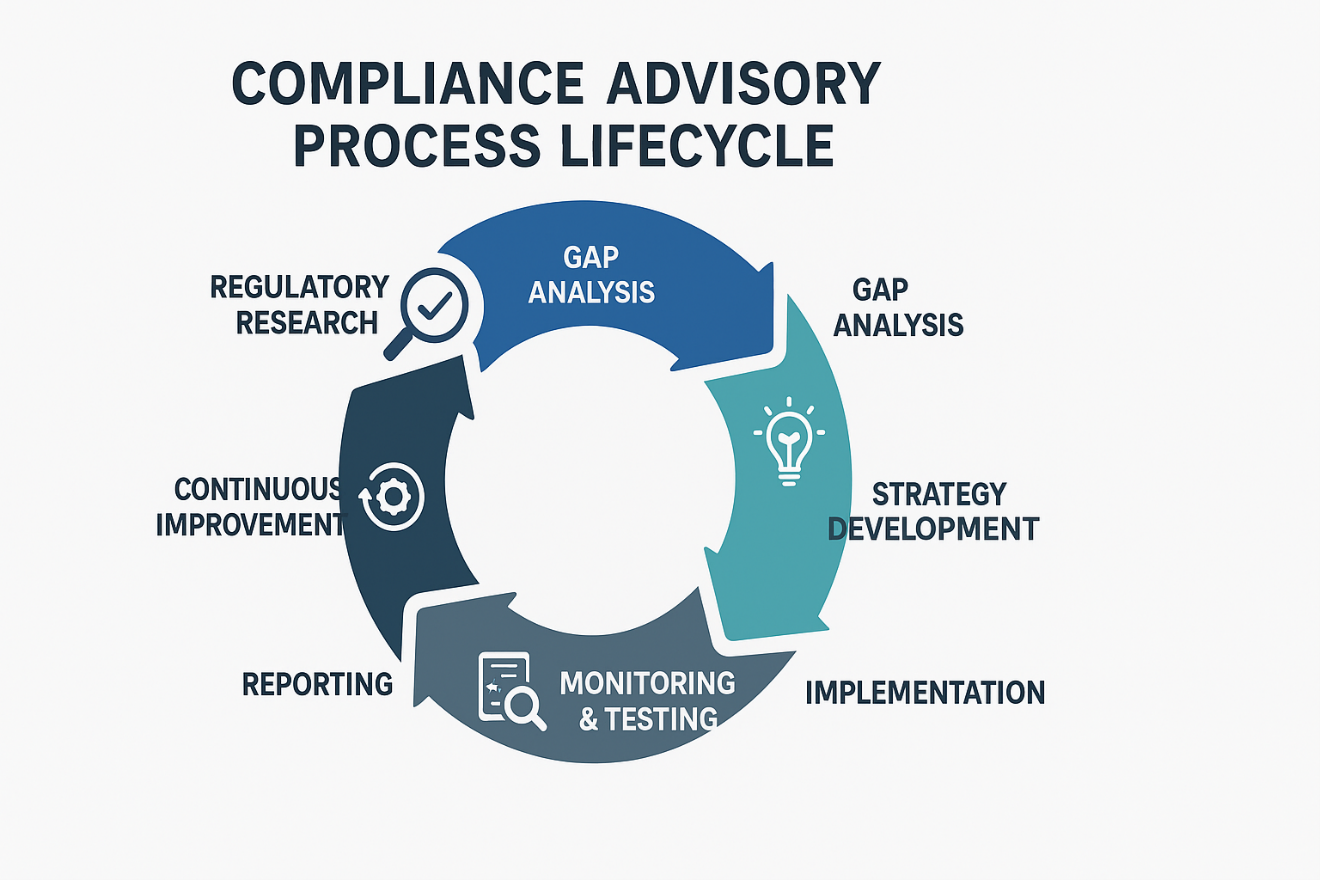

Compliance Advisory Process Lifecycle

Regulatory Complexity and Fragmentation

Capital market compliance is challenged by multiple jurisdictions and overlapping regulations, making adherence intricate and resource-intensive

Rapid Regulatory Change

Keeping pace with evolving laws, standards, and reporting requirements demands continuous monitoring and adaptive compliance strategies.

Technology Risks

Cybersecurity threats and data privacy breaches pose significant risks, requiring robust IT controls and proactive risk management.

Market Abuse Detection

Sophisticated schemes, including insider trading and market manipulation, necessitate advanced surveillance tools and analytics to identify and prevent violations

Resource Constraints

Organizations often face the challenge of balancing the cost of compliance with operational demands, ensuring sufficient expertise and staffing.

Cultural Resistance

Embedding a compliance mindset across all levels of the organization is critical, as resistance can undermine policy implementation and regulatory adherence.

Benefits of Effective Capital Market Compliance Advisory

Legal Risk Mitigation

Effective compliance advisory helps organizations avoid fines, sanctions, and costly litigation by ensuring adherence to evolving capital market regulations.

Investor Confidence

By enhancing transparency and building trust with stakeholders, compliance frameworks strengthen investor confidence and long-term relationships.

Operational Efficiency

Standardized compliance policies and the integration of technology streamline workflows, reduce duplication, and improve overall operational performance.

Market Integrity

Strong compliance practices safeguard against fraud, market manipulation, and insider trading, preserving fairness and stability within capital markets.

Reputation Management

Maintaining a sound compliance posture supports positive corporate reputation, protecting the organization from reputational damage due to regulatory breaches

Competitive Advantage

Firms that demonstrate robust governance and compliance are more attractive to investors, partners, and regulators, creating a clear competitive edge in the market.

How ABM Global Compliance Helps Clients

ABM Global Compliance provides specialized advisory and support services to help clients in capital markets and financial sectors navigate complex regulatory environments. They assist by:

Ensuring Regulatory Adherence

ABM Global Compliance helps clients comply with local and international regulations, minimizing the risk of fines, penalties, and legal exposure.

Risk Mitigation

They identify and manage compliance risks through tailored policies, internal controls, and monitoring frameworks designed for the financial and capital markets sectors

Enhancing Operational Efficiency

By streamlining compliance processes with industry best practices and technology solutions, ABM reduces manual effort, errors, and operational bottlenecks.

Trade and Transaction Surveillance

ABM implements advanced systems to detect and prevent market abuse, insider trading, and fraudulent activities, protecting market integrity.

AML & KYC Compliance

They design robust anti-money laundering and customer due diligence frameworks to prevent financial crimes and ensure adherence to global AML standards.

Training & Awareness

ABM educates employees and management, fostering a strong compliance culture throughout the organization.

Regulatory Reporting

They assist in the accurate and timely preparation and submission of regulatory reports and disclosures, ensuring full compliance.

Adapting to Regulatory Changes

ABM keeps clients updated on evolving regulations and supports proactive adjustments to maintain ongoing compliance.